Excel Trading Journal Template Guide | Trade Options With Me 7/7/ · Start your own option trading journal today It is not very hard to create and maintain your own personal trading journal, it is entirely up to you how familiarised you are with excel spreadsheets and some excel formulas, of course. My options trading journal is very intuitive and self-explanatory 10/23/ · Download the Trading Journal Spreadsheet This journal has been specifically created for option traders rather than stock, futures or day traders. It’s important to note, you don’t have to use it in this exact format. Feel free to tweak it a little bit to include things that are important to you or remove things that you feel are blogger.comted Reading Time: 9 mins

The Best Option Trading Calculator Excel Spreadsheet

Option traders like me invest a lot of time into planning their options trading spreadsheet and managing their option positions.

Keeping track of trading records, in a good and easy to manage options trading journal, is probably one of the most important and crucial steps for every trader to become a highly profitable option trader.

The excel options trading journal has allowed me to easily check my results and filter all the data to review my actions, options trading spreadsheet. Although I options trading spreadsheet admit that keeping my Option Trading Journal up to date after every trading day requires disciplineit has absolutely improved my performance because collecting the data made me review and reflect about every trade even more.

It helps me to re-assess my option positions, and find the spots where I can and need to improve. The journal will become a perfect trading history logbook for reviewing strategies and past mistakes and successes.

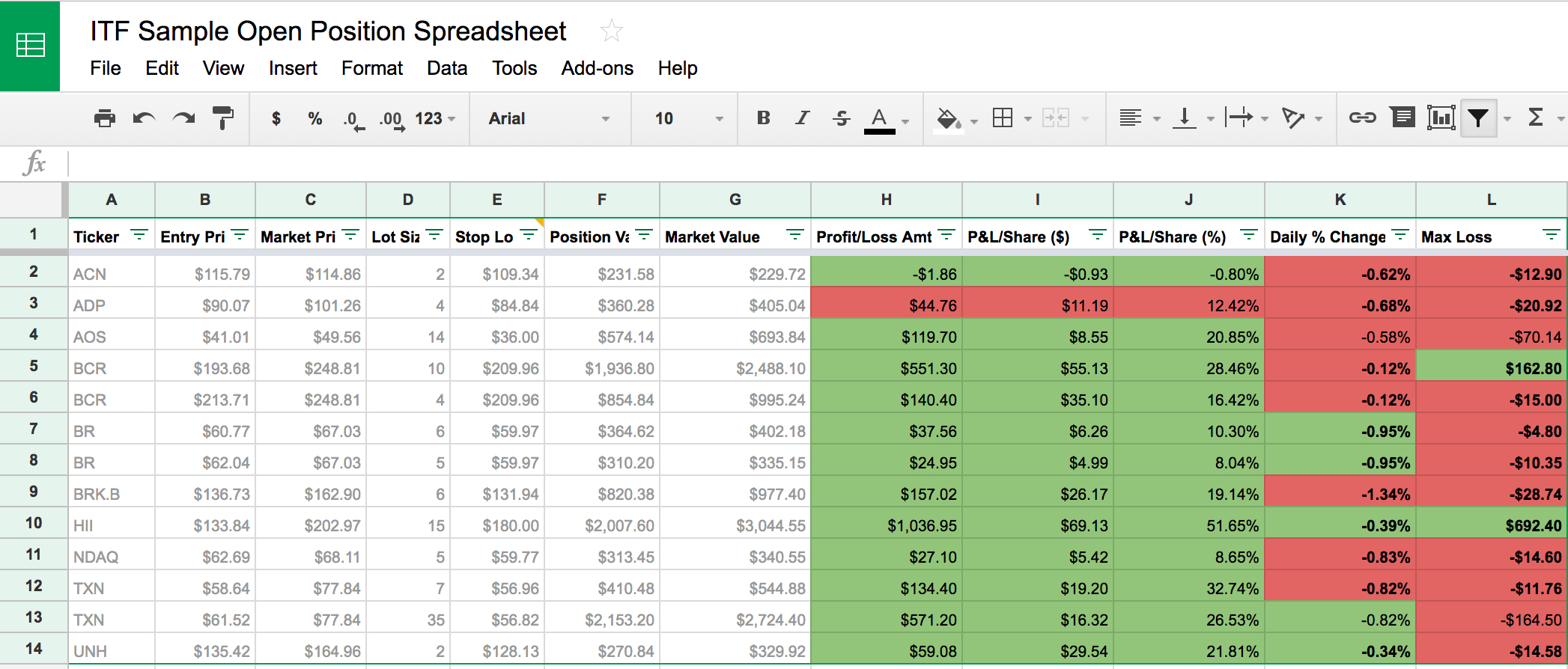

I have been tweaking this excel sheet completely to my liking and now it helps me to track my positions, to review my results and to take actions by calculating triggers and indicating colour alerts whenever required. In this post I will illustrate the benefits of starting an option trading journal and I will show what data I find useful to track.

Beginning option traders should start a trading journal right from the start, because I am convinced it is simply one of the most effective ways to improve your trading performance. It is not very hard to create and maintain your own personal trading journal, it is entirely up to you how familiarised you are with excel spreadsheets and some excel formulas, options trading spreadsheet, of course.

My options trading journal is very intuitive and self-explanatory. All my spreadsheets are updated and available at any moment to download for my Patreons.

This article, options trading spreadsheet, together with the video demonstrating the option trading journal, will allow you to have your own journal by the end of today, options trading spreadsheet.

And you can customise it to your liking, so that it works for you. Download the option trading spreadsheet on my Patreon Page. All the early community members of our TradingOptionsForCashflow facebook group can get the spreadsheet too on a simple request. Readers interested in the fields I track with my options trading journal can find the relevant fields and explanations below. With the goals of the journal in mind I have data entry fields and I have created also calculated fields.

My options trading journal has three parts: an opening position part, a follow up part and a closing position part. The white cells are ones that you manually edit and the grey cells are calculated automatically. Some fields are dropdown fields with the data linked to the list in the Data Fields tab. Here is the link again to my spreadsheets : Download spreadsheet on my Patreon Page.

To add a new line, I usually copy the row of last entry and past it above in a new added row. i usually add at once. I hope this clarifies it a bit.

Options trading spreadsheet KB, options trading spreadsheet. Would love to download your spreadsheet but if I have to pay monthly just to get to the download. no thank you. No results. Start here Trades Blog My Trade Results Guide to Selling Puts About My why Free Facebook Group.

We use cookies to ensure that we give you the best experience options trading spreadsheet our website. Accept Decline. Reasons to keep a trading journal Why do I keep a trading journal? And why should you? Start your own option trading journal today It is not very hard to create and maintain your own personal trading journal, it is entirely up to you how familiarised you are with excel spreadsheets and some excel formulas, of course.

Download the option trading spreadsheet on my Patreon Page All the early community members options trading spreadsheet our TradingOptionsForCashflow facebook group can get the spreadsheet too on a simple request. Data fields of my options trading journal Readers interested in the fields I track with my options trading journal can find the relevant fields and explanations below.

Date Init Open : is the actual date options trading spreadsheet the option contract was opened or the new position was established.

Ticker : is the ticker symbol for the stock underlying the option contract, used to identify the stock on the stock options trading spreadsheet and relevant websites such as Yahoo finance.

TrType Open : the type options trading spreadsheet Transaction to open a position is either Sell to Open STO or Buy to Open BTO.

Strategy : dropdown choice of the selected the strategy of the trade, such as put, call, strangle, iron condor, options trading spreadsheet, iron fly, options trading spreadsheet, call spread, put spread, jade lizard and big lizard. Strategy Description : I use this field to make a brief description of the trade is that I can quickly identify the trade. UL Price : options trading spreadsheet the underlying stock price at the moment the position is opened on the transaction date.

Strike price : is the set price of the option contract at which the underlying stock can be bought or sold when it is exercised. Exp Date : is the expiration date meaning the date that options trading spreadsheet contracted is scheduled to end. IVR Open : is the Implied Volatility Rank of the stock at the moment the position is opened on the transaction date, options trading spreadsheet. PoP : stands for Probability options trading spreadsheet Profit and it gives expressed in percentage the expected chance that the trade will have a positive result, will be a winner.

Init DTE : stands for Initial days till Expiration, and is the amount of days left on the option contract, at the moment the position is opened on the transaction date.

Qty : stand for the quantity of contracts for the new opened position in my case practically always just one, because I follow the principle trade often trade small. Prem Open : stands for premium received credit when selling to openis the money collected for selling the global position.

Tot Fee Comm : stands for Total Fee and Commissions, and is the amount that has to be paid to your brokerage for executing the transaction, options trading spreadsheet. MargReq : stands for Margin Requirement, is the actual cost of the investment, also a determine factor for the return on investment. Suggested reading : Cash and options trading spreadsheet accounts explained with practical trading examples.

Data fields relevant for following the positions Days held today : is the amount of days I am already holding the option contract at current date today. Current premium : is the current option price.

Updating the premium price will adjust the alert triggers that I use in the spreadsheet. DTE : options trading spreadsheet for Days unTil Expiration and is the amount of days left on the option contract, options trading spreadsheet, at current date today.

This parameter is used to trigger alerts to manage the position eg. CurrNetProfit : is the actual Current Net Profit based on the value the current premium, options trading spreadsheet. This field helps to determine if you want to manage a positions based on the targets eg.

BEP Down or Up : stands for Break Even Point Down and is currently only used to calculate the BEP for short puts or short calls. Date Close : is the actual date that the option contract was sold or has expired and thus the position was closed. If the position was adjusted, no date is required in this field.

TrType Close : stands for the Transaction Close Type and is the type of Transaction to Close a position options trading spreadsheet either Buy to Close BTC or Sell to Close STC. UL Price : is the underlying stock price at the moment the position is closed on the transaction date. IVR Close : is the Implied Volatility Rank of the stock at the moment the position is closed on the transaction date. Qty : stand for the quantity of contracts for the closed position in my case practically always just one.

If a partial close is made, options trading spreadsheet, a new position must be opened with the remaining quantity. Prem Close : stands for premium paid debit for buying back to close or received to close the position.

Tot Fee Comm : stands for Total Fee and Commissions, and is the amount that has to be paid to your brokerage for executing the closing transaction. Days Held : is the calculated field of the number of days between the opening and closing of the position. Net Profit : is a calculated filed of the realised net profit ROI : is a calculated filed of the realized return on investment expressed in percentage for the net profit made on the investment cost in the field margin requirement.

Ann ROI : is a calculated field of the realized, non-compounded annualized return on investment expressed in percentage for the net profit made on the investment cost in the field margin requirement, taken into account the number of days the position was held. Link : is the field used to link this transaction to the SrNbr of another position when the transaction of the position is an adjustment to a new position.

Comment : a field used for any useful comment for later review. Comments options trading spreadsheet suggestions Please feel free to give me your thoughts and suggestions in the comment section below. Notify of.

new follow-up comments new replies to my comments. Oldest Newest Most Voted. Inline Feedbacks. Jeroen Beltman. It works exactly like I wish to monitor my option trading. But how do I add a trade? Reply to Jeroen Beltman. Hello Jeroen, I must have missed your message, sorry for my late reply.

The most advanced Excel Sheet for Option Trading - Macro \u0026 VBA Programming

, time: 7:54My Options Trading Journal - Excel spreadsheet - TradingOptionsCashflow

Traders can use the power of Excel to gain an advantage in the marketplace by designing their own analytical tools and indicators. The easiest way to do this is by enabling MarketXLS in excel. By using this feature, you can crunch data, analyze it, and get answers to the most complex questions thereby resulting in pushing blogger.comted Reading Time: 5 mins Excel Trading Journal Template Guide | Trade Options With Me 7/29/ · This spreadsheet allows you to keep track of each of your trades and manage them in one place. Click here to access the Options Tracker Spreadsheet on Google Sheets Created at blogger.com After opening the spreadsheet in Google docs, you must click “File > Make a copy” to be able to start using it

No comments:

Post a Comment